.png)

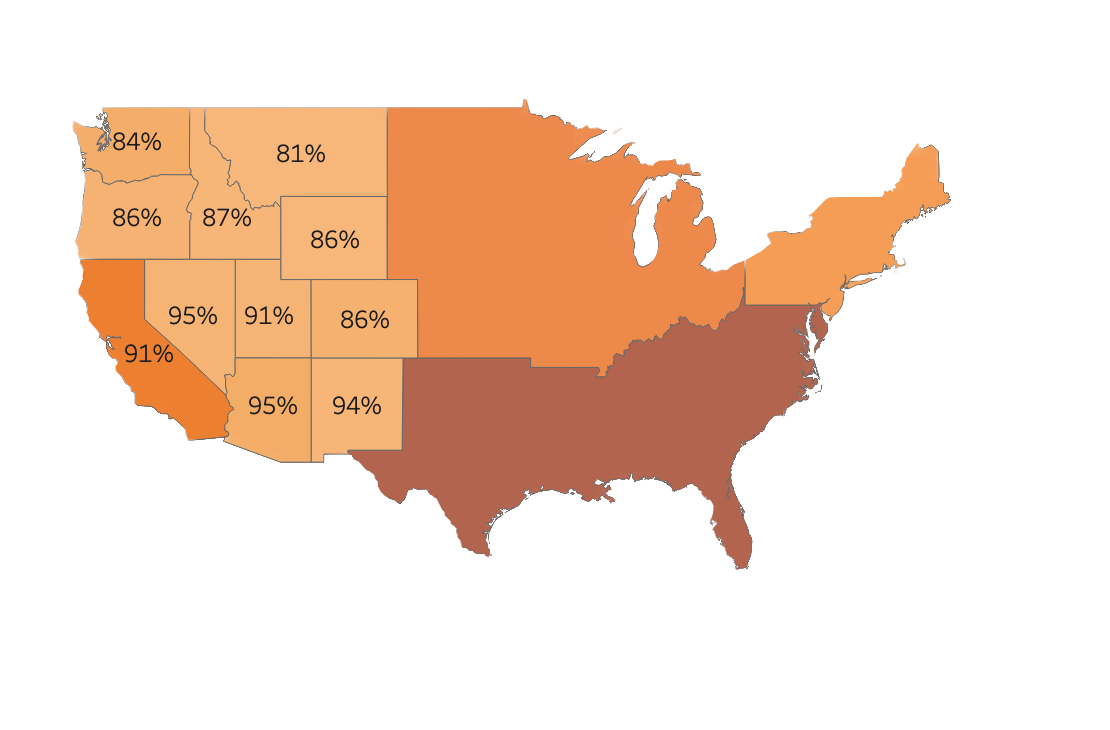

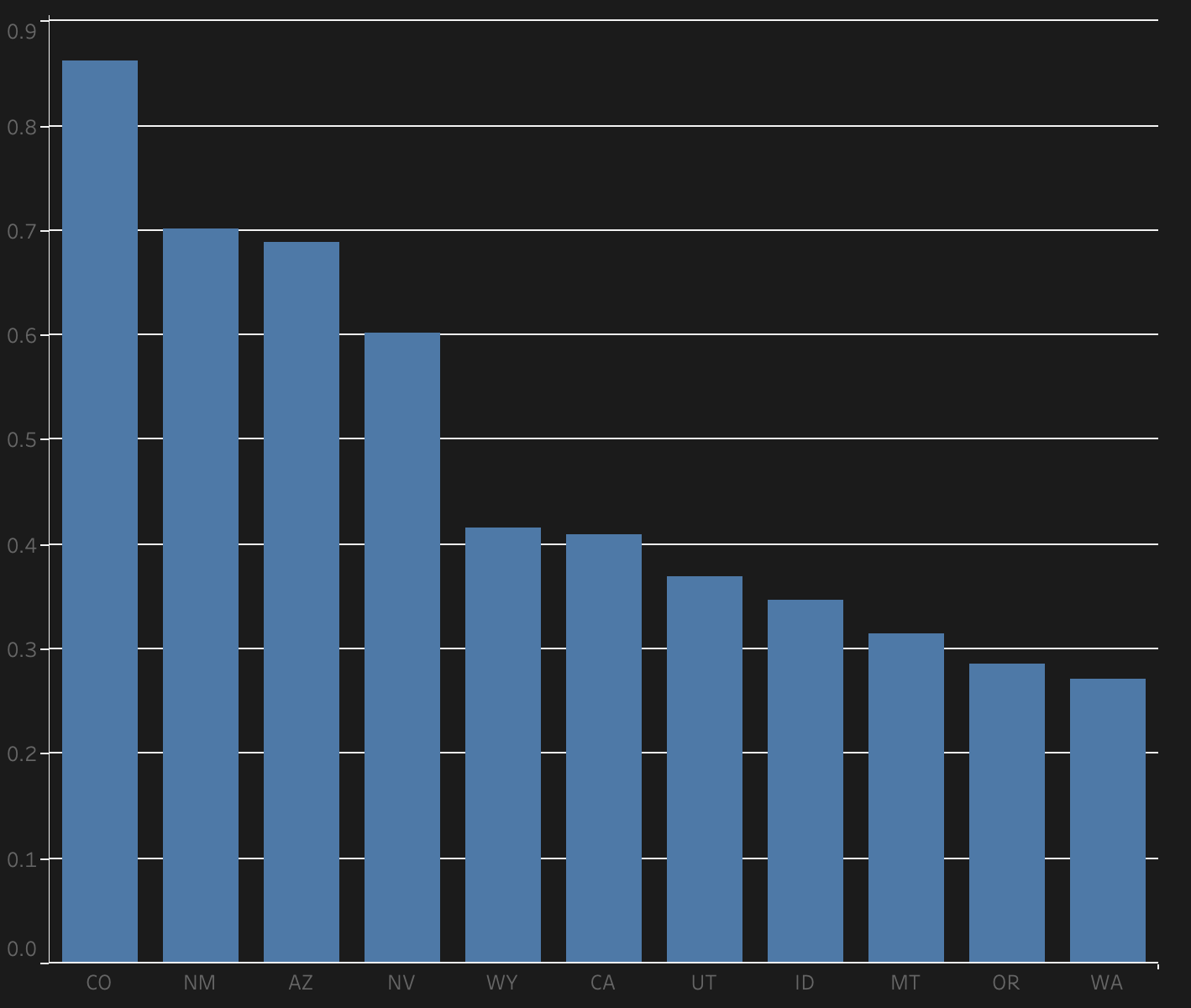

Competing Markets: Install Ratio

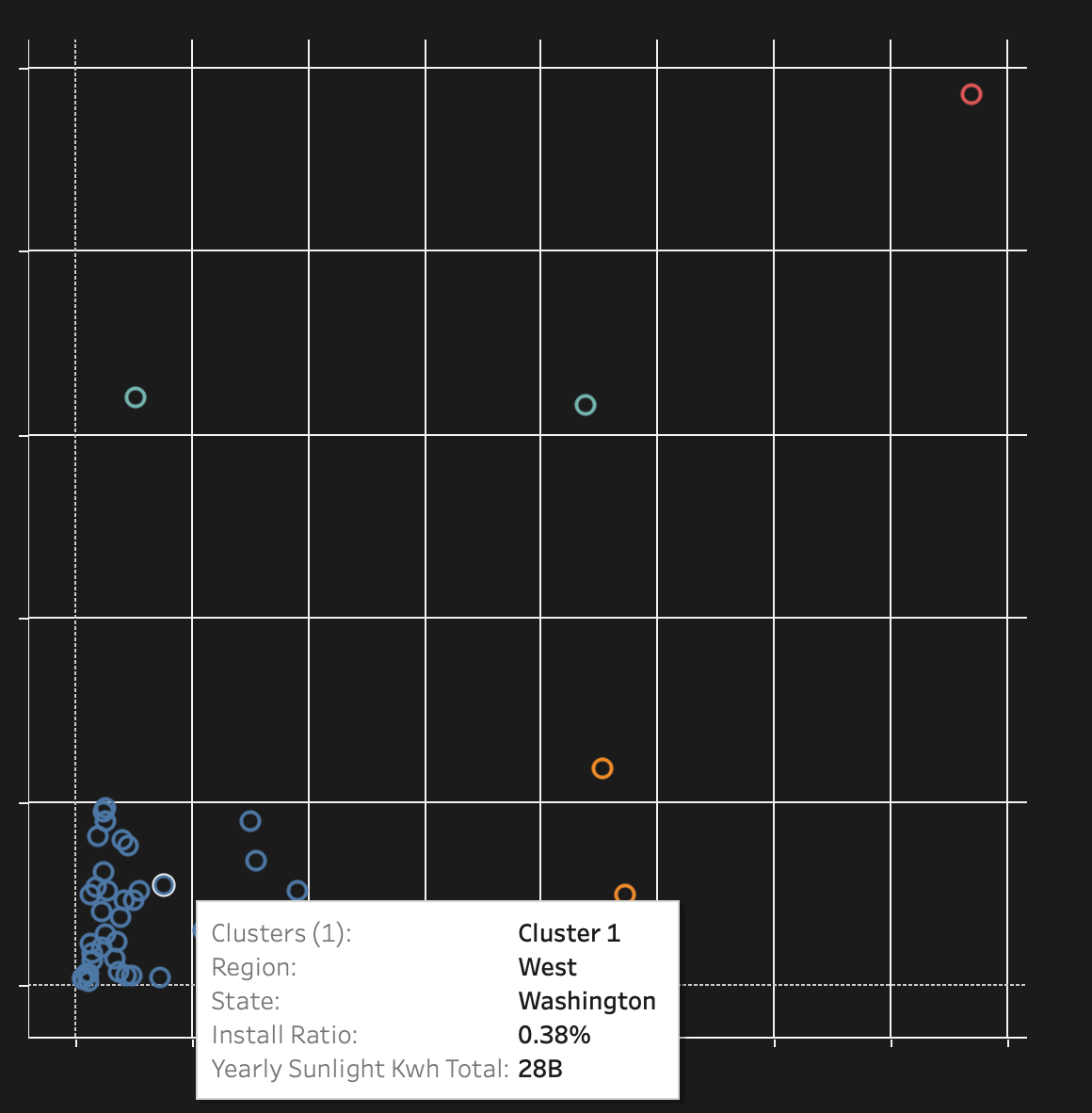

Primary Focus: For new solar businesses, states with low install ratios and high yearly sunlight kWh like Michigan, Ohio, Alabama, Georgia, and Pennsylvania are attractive options. These states offer significant untapped markets with promising solar energy generation potential.

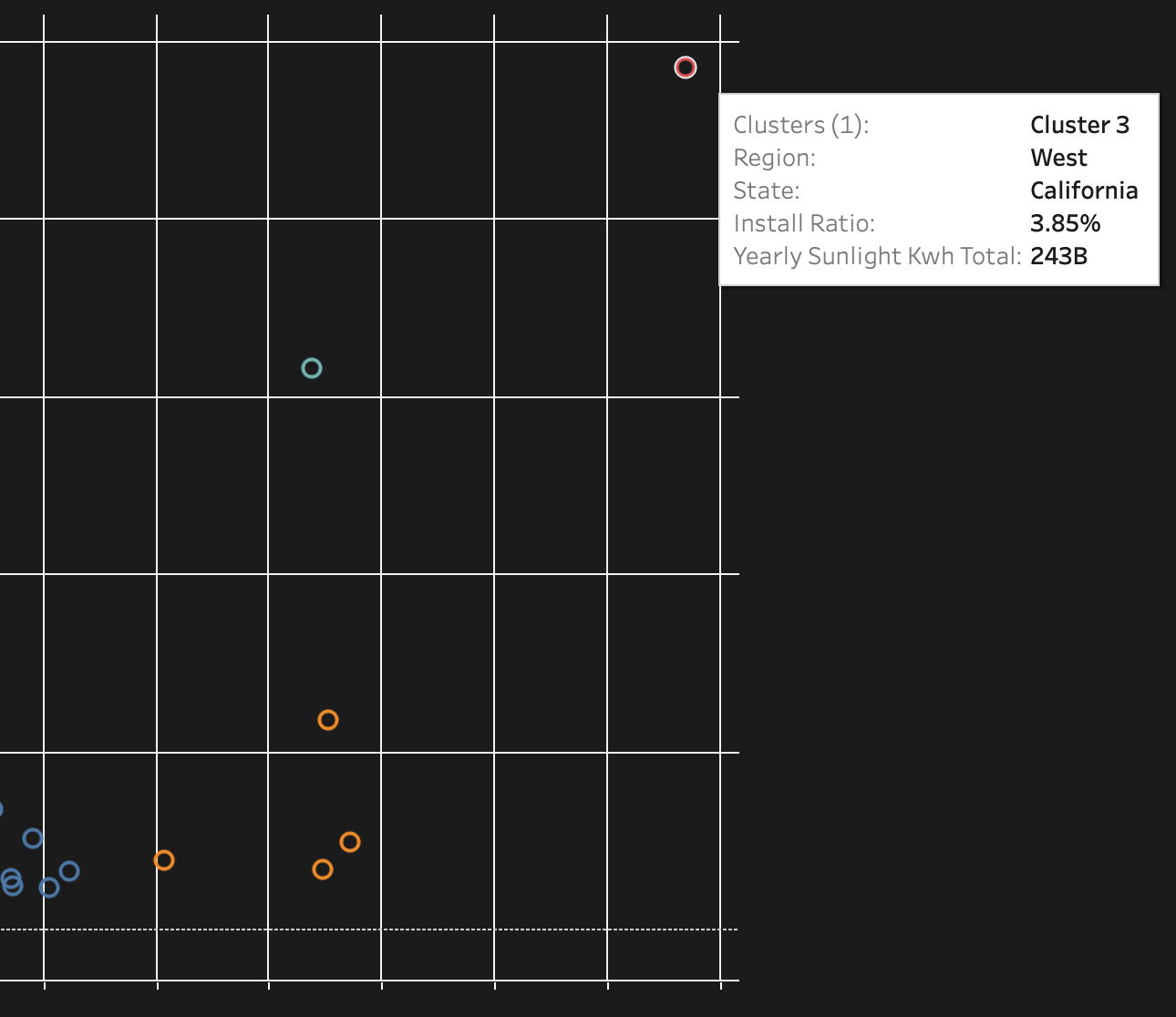

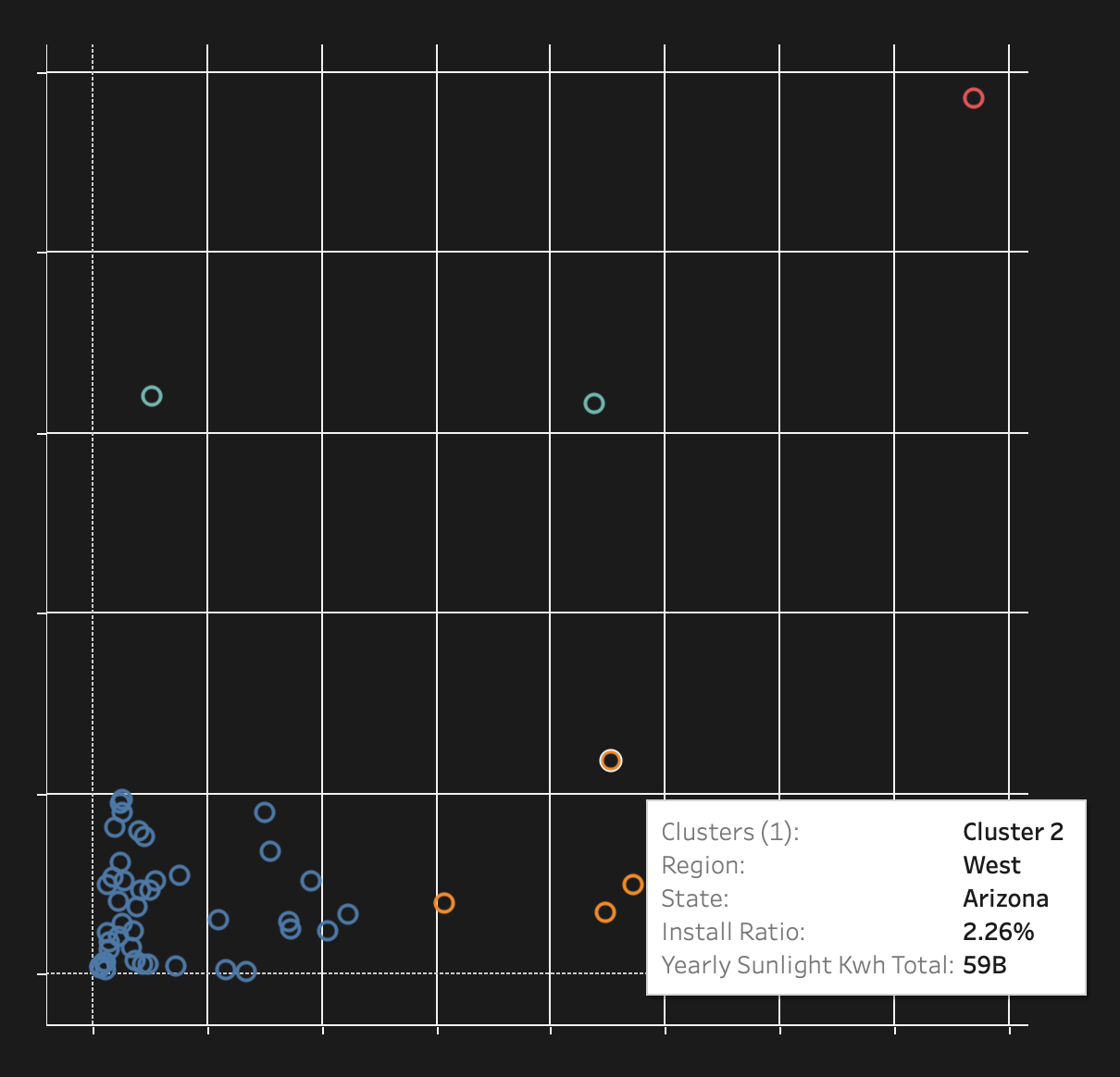

States with high install ratios, such as California (3.85% install ratio, 243B yearly sunlight kWh), Arizona (2.26% install ratio, 59B yearly sunlight kWh), and Nevada (2.24% install ratio, 17B yearly sunlight kWh) in the West, along with Florida (2.19% install ratio, 158B yearly sunlight kWh) in the South, indicate a significant level of market saturation.

Competitive Landscape: High install ratios suggest that a large portion of the potential market has already been tapped. This leads to a highly competitive landscape, making it difficult for new businesses to establish a foothold.

Secondary Focus: States with moderately low install ratios like Utah and Minnesota can also be considered. They provide a balance between market potential and competition.

Strategic Market Entry: New businesses should focus on education and awareness campaigns in these states to tap into the untapped potential. Given the low install ratios, there is likely a lack of awareness or perceived barriers to solar adoption that can be addressed through targeted marketing efforts.

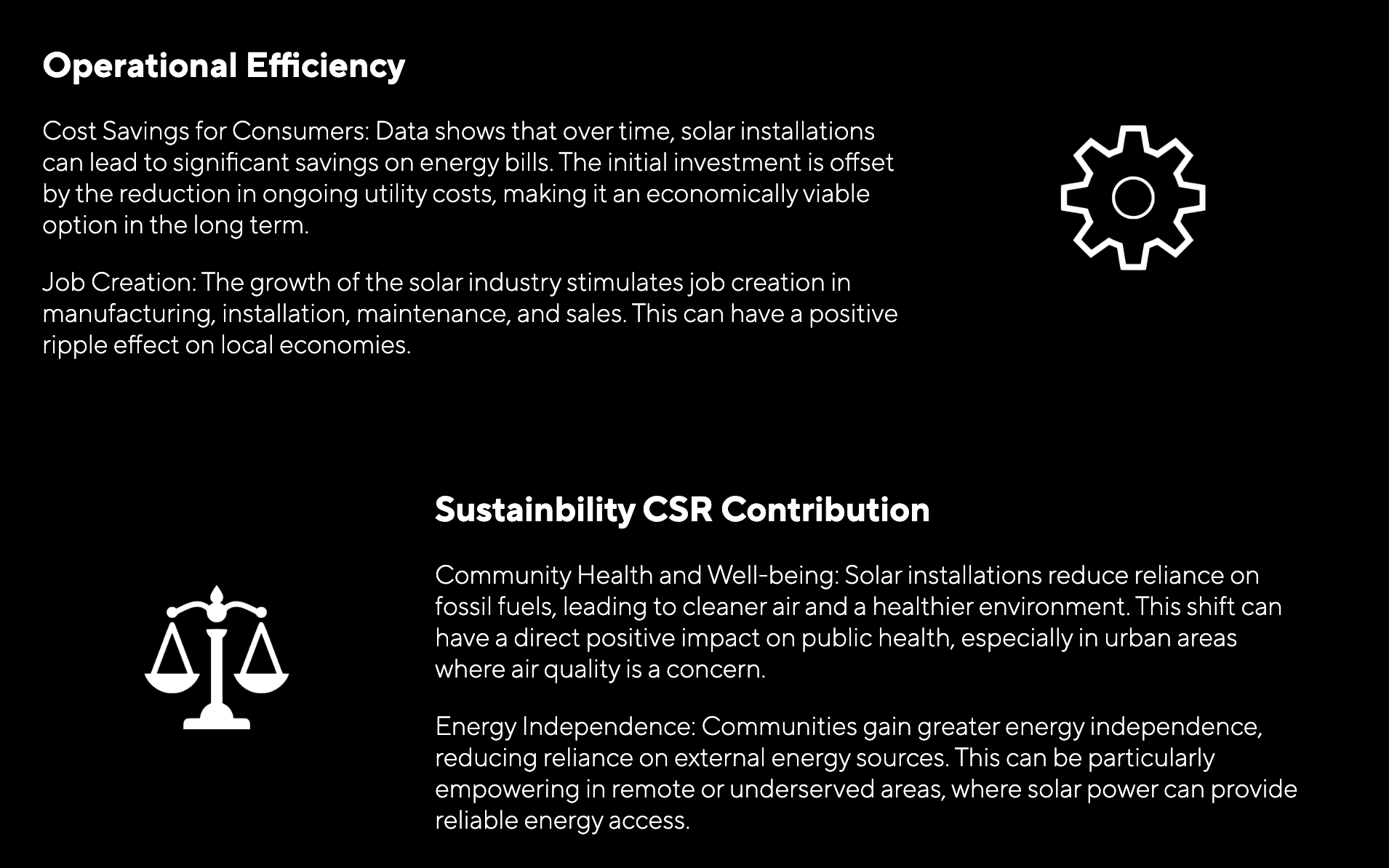

.png)

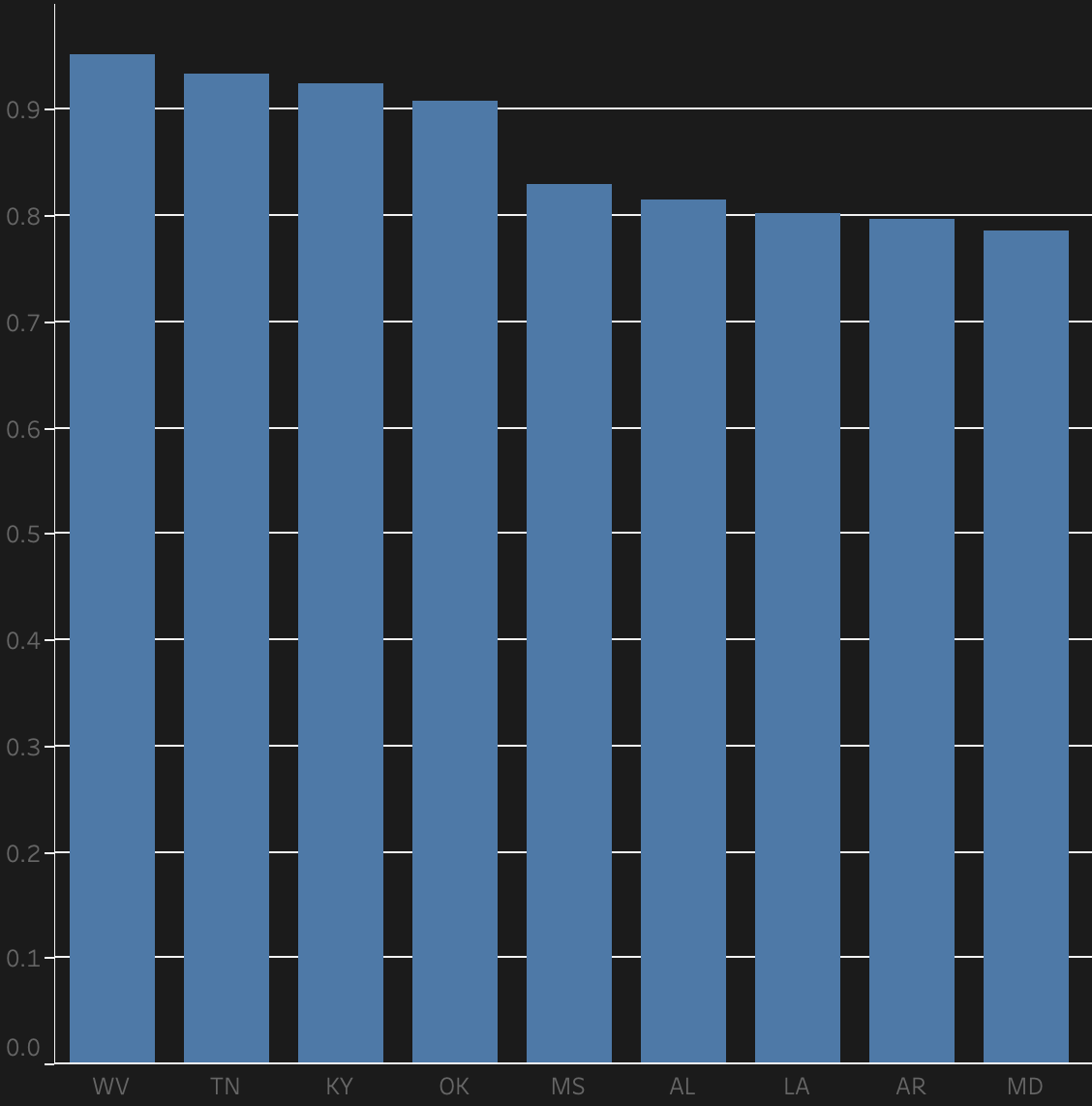

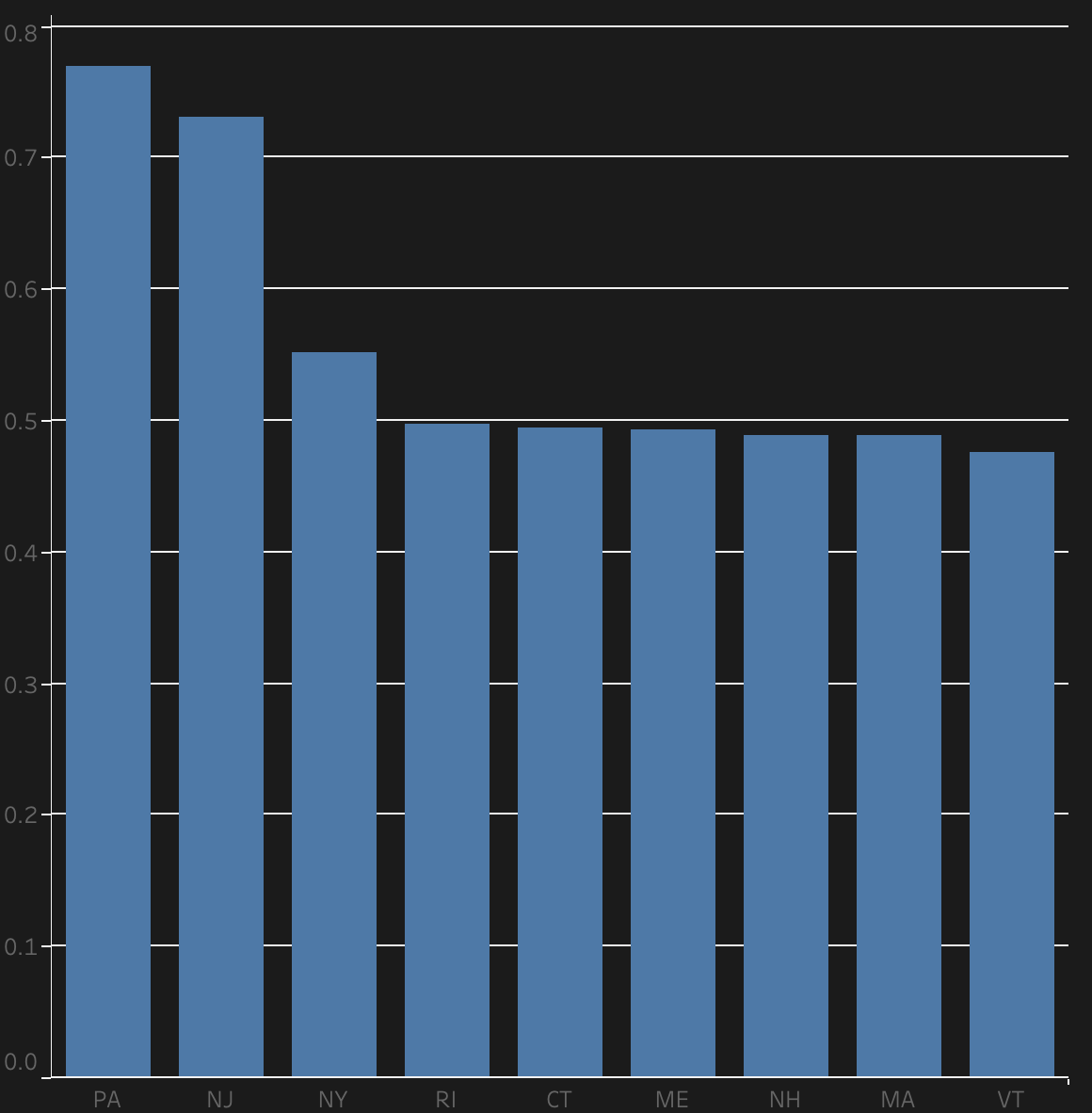

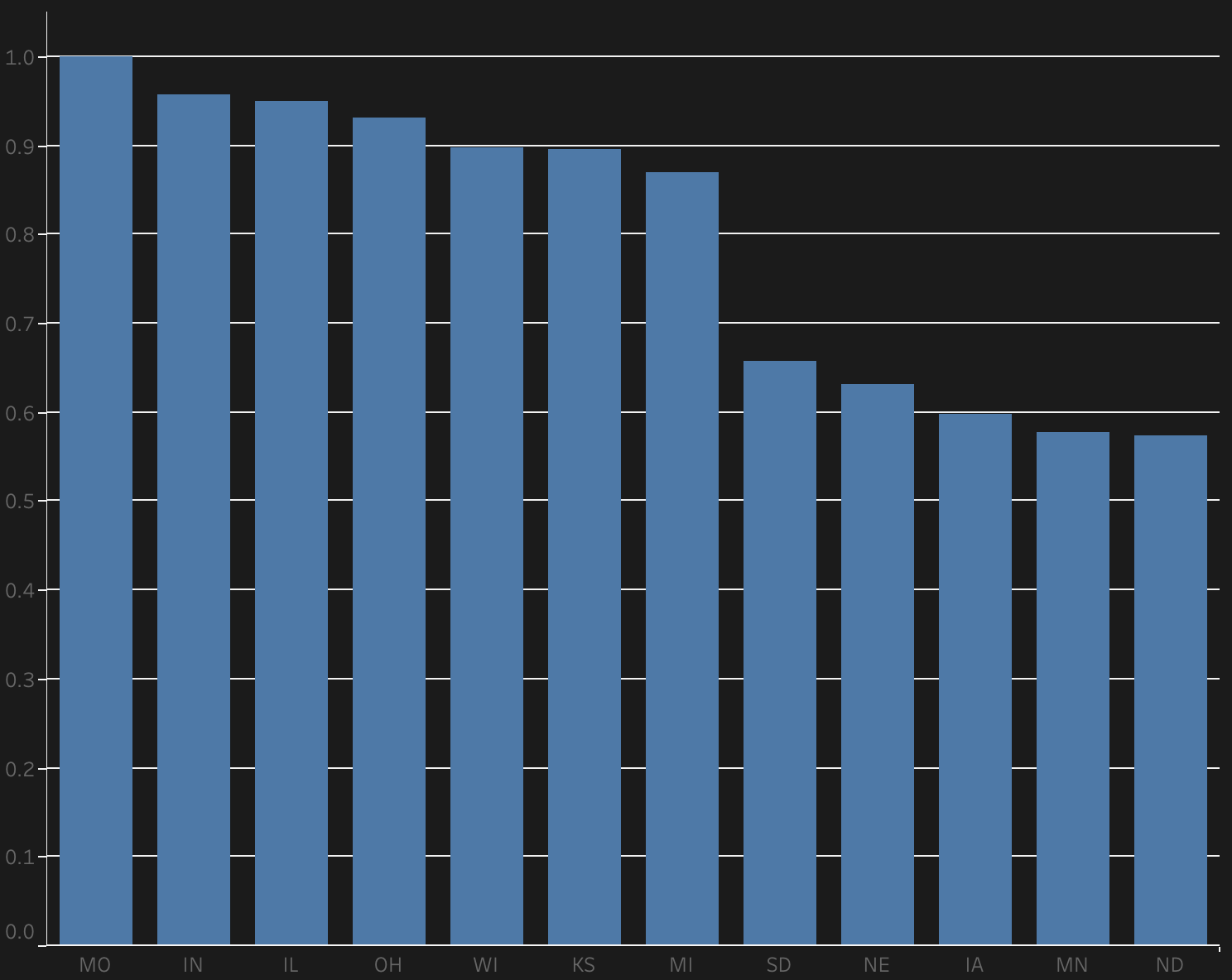

Analyzing the average percent qualified for solar installations across different regions and states provides valuable insights for determining suitable locations for new solar businesses. The "percent qualified" metric indicates the proportion of buildings or homes in an area that are deemed suitable for solar installations. A higher percentage suggests a greater number of potential customers.

Primary Focus:The West and South regions, with their high percent qualified, present lucrative opportunities. These regions have a large number of buildings suitable for solar installations, suggesting a substantial market size.

Secondary Focus: Midwest states like Illinois, Indiana, and Ohio also offer promising prospects due to their high suitability and a large number of potential installations.

Strategic Market Entry: The Northeast region, while having a slightly lower average percent qualified, still represents a significant market. States in this region should not be overlooked, especially for businesses looking to diversify geographically.

03. Final Recommendations

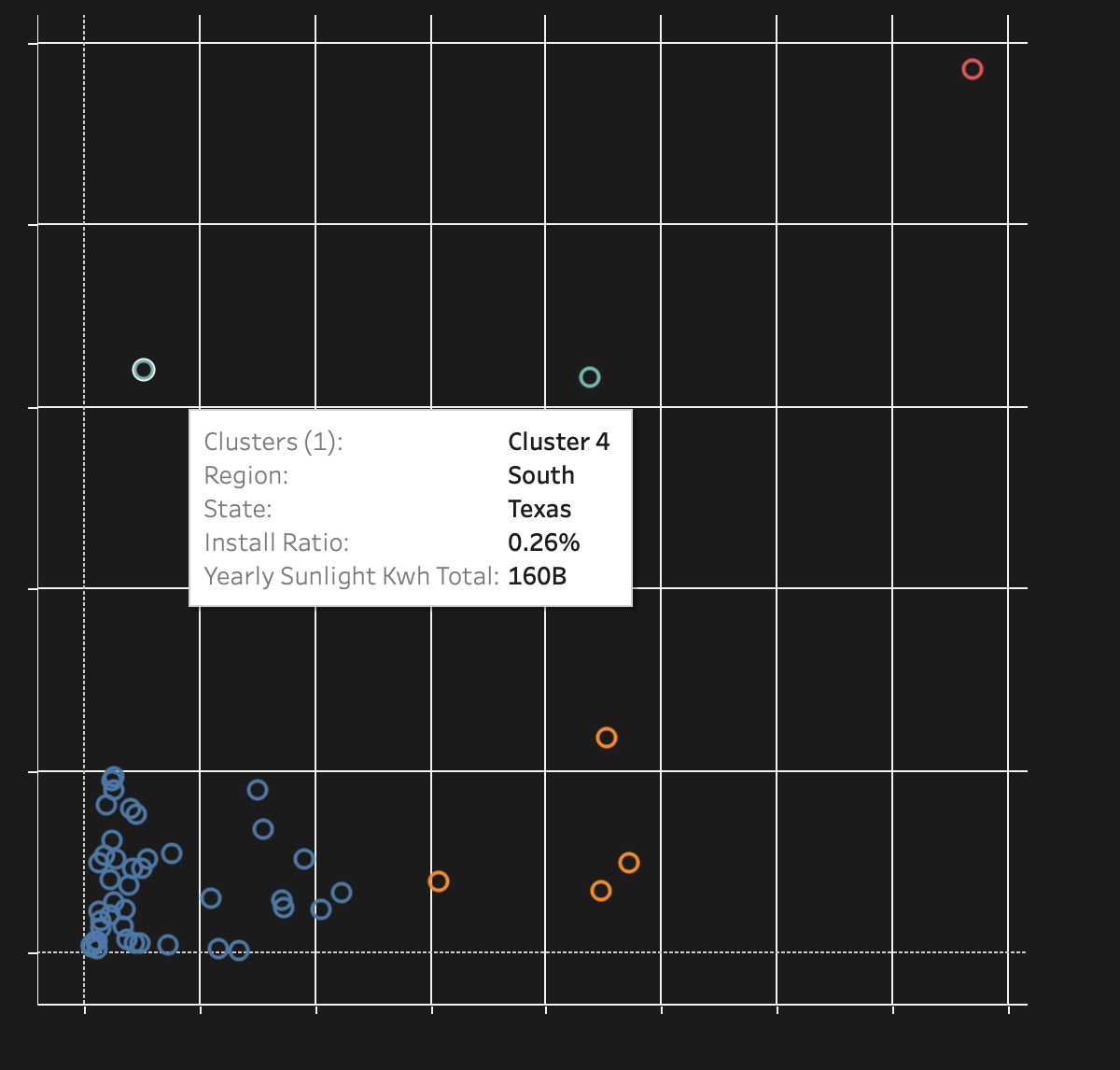

This recommendation depends on numerous factors. Assuming the client is looking to set up a business in a place with both ample opportunities for installation (low install ratio) and high customer interest rates (presumably highest in states with the most yearly sunlight), the best state to set up a business would be Texas.

The "percent qualified" for Texas, is approximately 90.49%. This means that around 90.49% of the leads in Texas meet the criteria or qualifications for a sunroof business. Texas has a relatively high percentage of qualified leads in comparison to other states, making it an attractive location for a sunroof business.

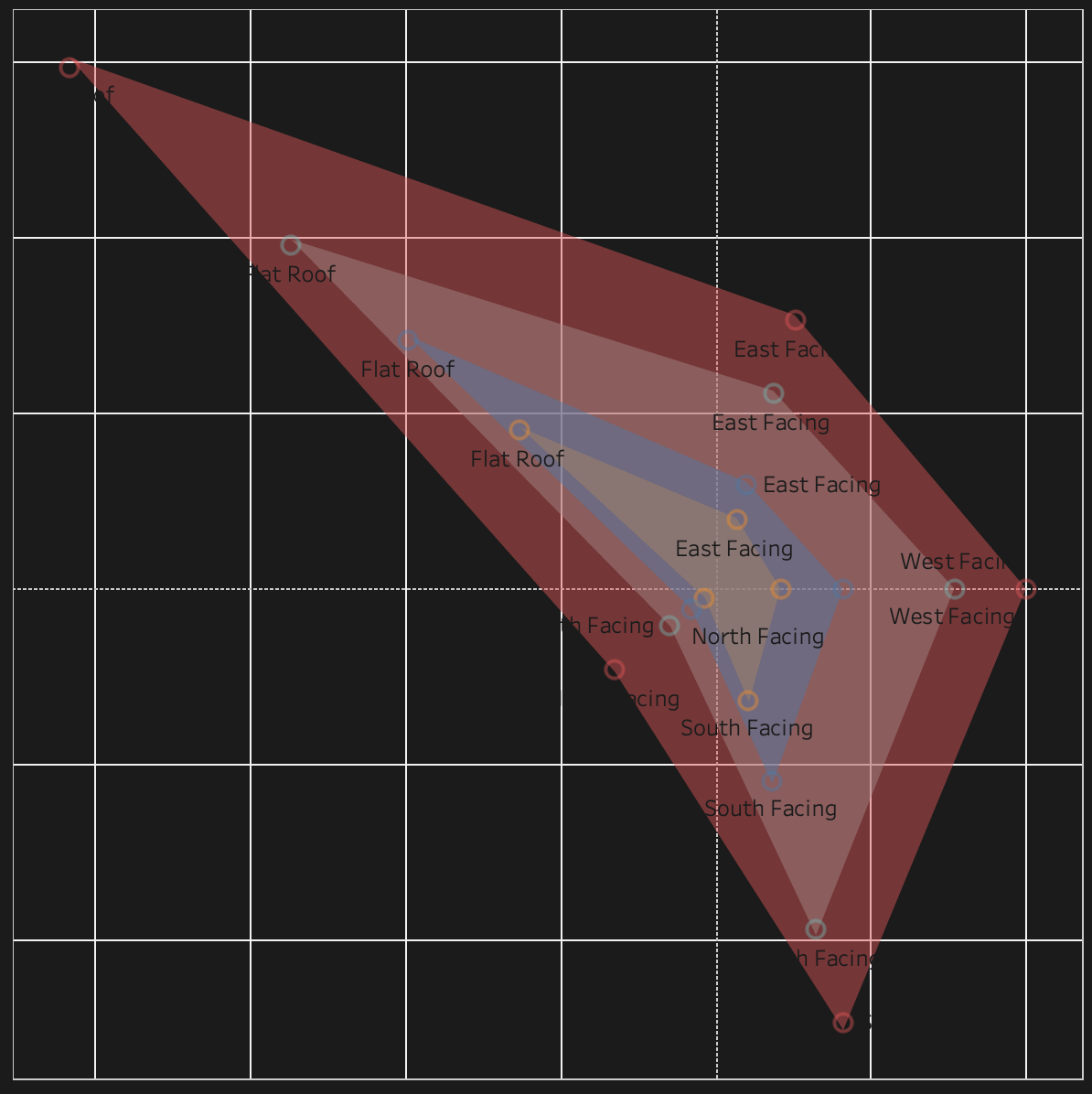

Texas also has a high sunlight potential with 160B yearly sunlight. Hence those with flat roofs and a strong orientation towards south-facing roofs should be a primary consideration and can be ideal for solar roof installations. This is because this directly correlates with the amount of solar energy that can be generated. More sunlight translates to higher energy production, making it a large factor for a successful solar business. Southern regions with flat-facing roofs also generate the most amount of yearly sunlight making them ideal.

The install ratio is also moderately low indicating that there is still room for growth and expansion in the solar market. This means that there is demand for solar installations, but the market is not overly saturated. While California has the highest sunlight potential the high install ratio might suggest that the market is already saturated, and competition is fierce. This would not make it ideal. Texas strikes a balance between relatively high sunlight potential and a moderate install ratio. The install ratio is also not extremely low which indicates a lack of demand or potential regulatory barriers.

In terms of carbon offsetting, Texas is relatively low at 66% in comparison to other states in the south. However, when it comes down to looking between California it is higher. There are potential financial gains to a lower carbon offset including lower operating and lower costs. However, there are limits in accessing the carbon offsets markets which reduces opportunities to generate revenue.

You might also want to see...

.png)

.png)